Improve Your Portfolio in Under Five Minutes

Our investment philosophy starts with you. On the path to financial success, you need to determine four things:

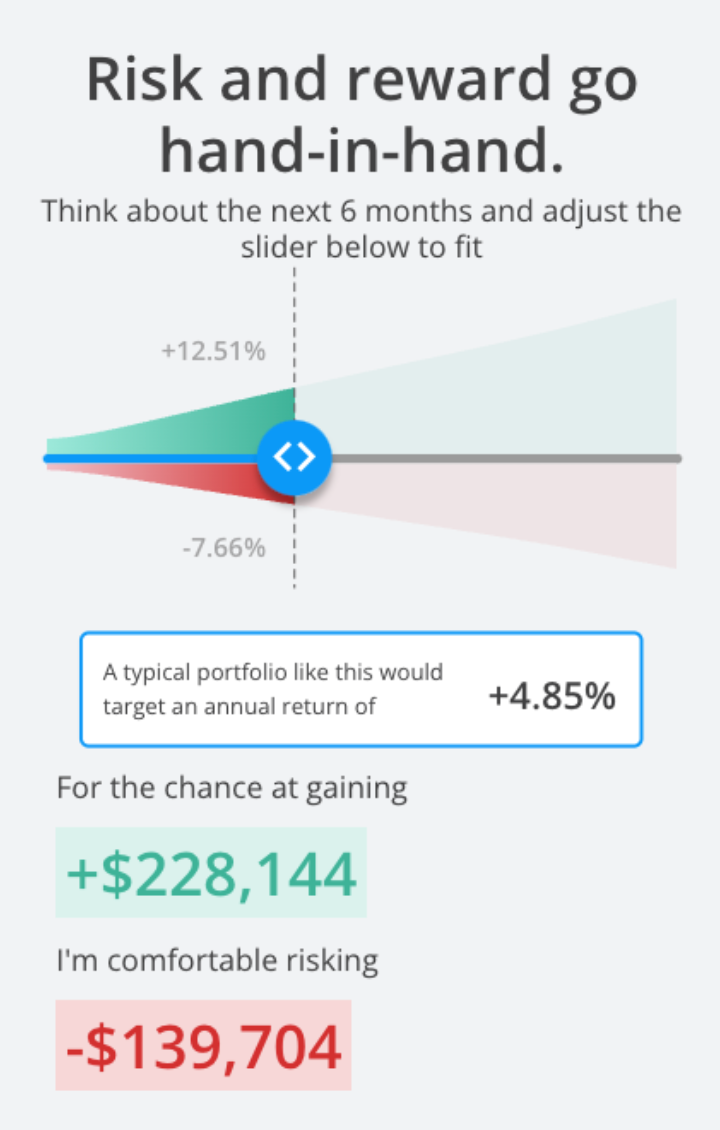

How much risk do you want?

We’ll take a quantitative approach to pinpointing your Risk Number® by going through a series of objective exercises based on actual dollar amounts.

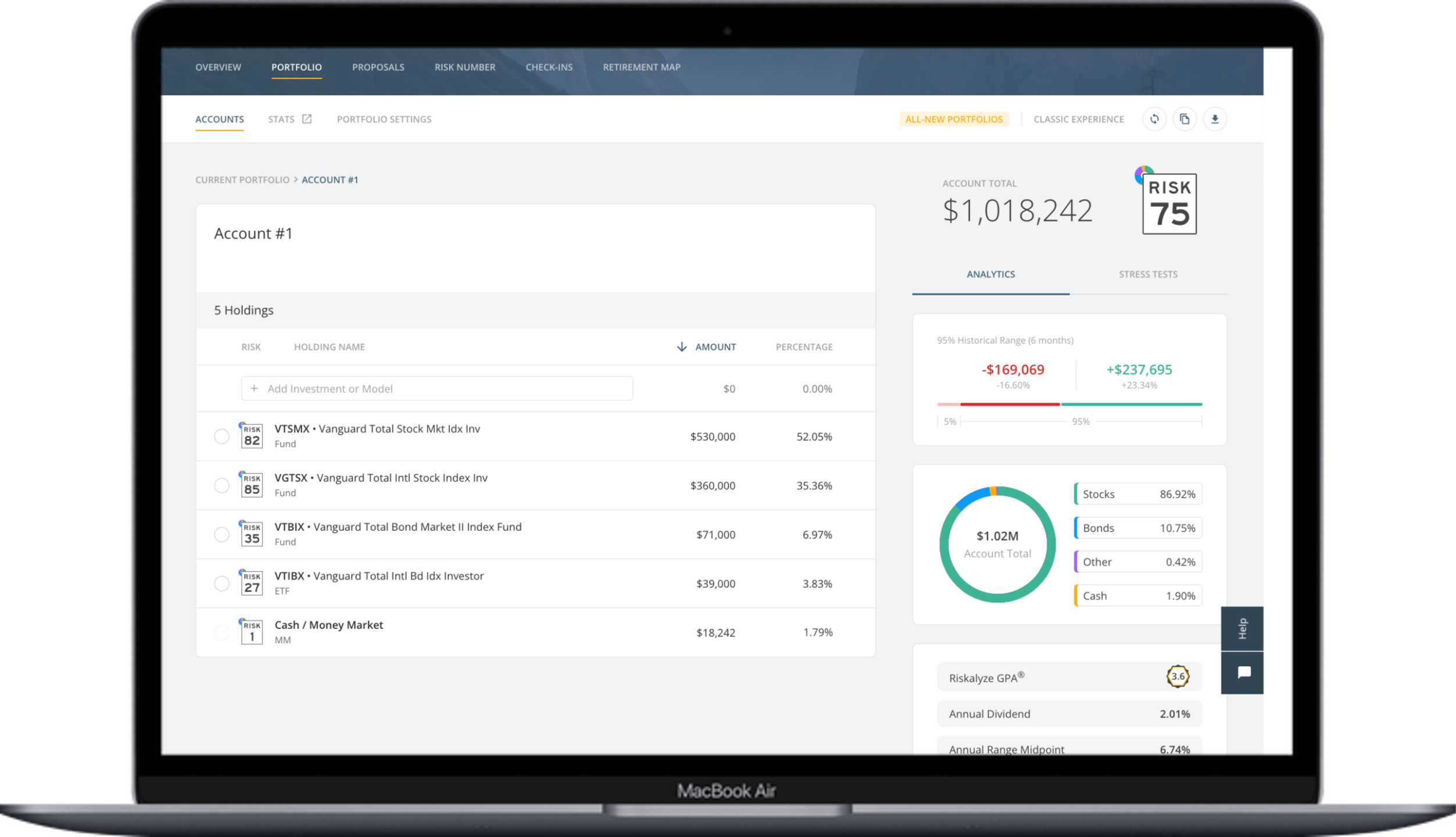

How much risk do you have?

If you’ve already got an investment portfolio, we can quickly import it and see if your Risk Number® aligns with your current amount of Risk.

How much should you have?

Your investment account is a means to an end - you save and invest with a goal in mind. We’ll use all these factors to build an optimized portfolio that fits your risk tolerance and goals, giving you the best chance for success.

How much risk do you need?

We can chart a path to your goals using a simple, intuitive approach. We’ll visualize the probability of a successful retirement and adjust in real-time.

What's Your Risk Number?

Find Out HereOur Promise to You

You can expect a transparent process and ongoing communication from the beginning. After opening your account and investing funds, we establish periodic and consistent review meetings over the long term to ensure that your portfolio is fully aligned with your stated goals. We make ourselves available as a resource for any financial questions or concerns you may have.

Does this describe your current situation?

- You haven’t heard from your current adviser

- You don’t feel valued – you’re just an account

- You see no apparent strategy or rationale for the positions you own

- You keep getting pitched for products you don’t need

- You feel like you’re not getting value for the fees you’re paying

- You’ve been managing your money on your own, but feel it may be time to delegate

The value in working with CameronDowning:

- We’re fiduciaries – you’ll work with a dedicated team of CFP® professionals

- No products, no hidden fees, no commissions, no sales tactics – EVER!

- We’ll help you avoid the mistakes that many investors make

- We optimize for tax efficiency and invest in low-cost ETF's

- You’ll understand what’s in your portfolio and why

- Easy communication via phone, email, and text

- We’ll respond promptly to any inquiry

- An annual service calendar you can see and count on

Fee Schedule

Our investable asset minimum is $250,000 per household. Fees are deducted from your investment account according to the following tiered schedule.