You are looking for a fiduciary financial advisor who can take you to the next level. Our experienced team will work with you so you can achieve your financial goals.

Not your average CFP® professionals.

Most financial advisors will tell you they can help you achieve financial freedom.

We show you how and walk the path with you.

Become Financially Fit

Take your finances to the next level.

You've made some good financial decisions in your life. Let's take a good thing and make it better. Working with a fiduciary financial planner at CameronDowning is a lot like working with a personal trainer. It requires commitment, dedication, and discipline.

Advice-based financial planning.

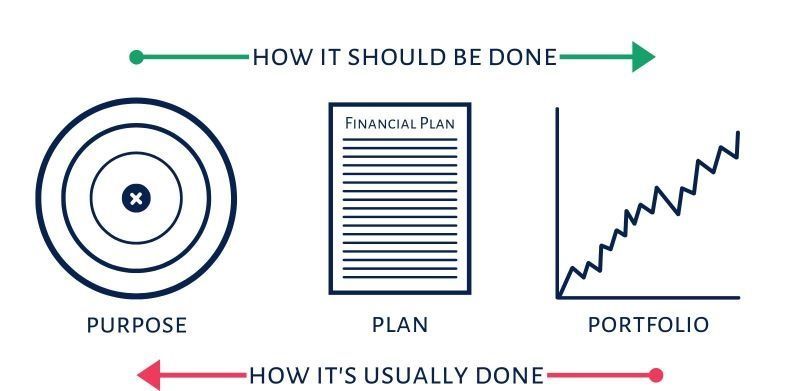

You wouldn't hire a personal trainer to sell you weights. Why hire a financial advisor to sell you products? We believe financial planning should be advice-driven and customized to your specific needs. We'll keep you accountable and motivated for what's ahead. By the same token, your investments should be aligned with your financial plan.

Why we do it.

Our mission is to help people become the best version of themselves through financial planning and investment management. We do this by building up -- our clients so that they meet their financial and life goals, our employees so that we achieve personal & professional objectives, and our community since we have a responsibility to serve our neighbors in need.

As Seen In: