The S&P500 Hits A 52-week High

Jul 07, 2023

The market rally continues, May inflation comes in cooler, and more.

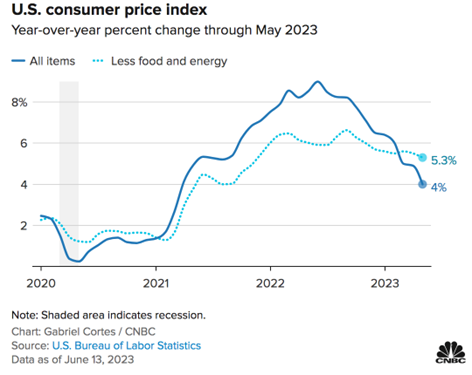

On Tuesday, June 13th the S&P500 hit a 52 week high. Right on the heels of a 4% Year-over-Year inflation read for the month of May.

Here’s where inflation stands:

Later that week, the Federal Reserve decided to skip interest rate hikes.

This was along-awaited break after 15 consecutive months of rate hikes.

The battle against inflation is working and we’re reaching the end of the tightening cycle. Between the credit term tightening by banks after the bank collapses in March, and student loan payments resuming soon ($18 billion in consumer spending will have to be redirected towards loan payments per month), the Fed thought it prudent to skip a rate hike in June.

At the FOMC press meeting, Fed governors indicated they felt a need for an additional 0.50% increase to current rates this year, putting us closer to 5.6% by the end of 2023. However, this remains to be seen, after all the time lag for monetary policies is notoriously long. Our opinion? A rate cut is not completely off the table before year-end.

And the market? Well, the market is rallying. With the S&P500 and NASDAQ both up YTD, markets are starting to price in a more stable interest rate outlook. This is good news for companies, investors, and potential economic expansion. When it comes to the United States markets and economy, “pessimists sound smart. optimists make money”.

What this means for you:

It bears repeating, as Glenn likes to say: “The government is not the economy, and the economy is not the stock market”. In the last month - despite the political and bureaucratic drama the S&P500 gained another 6%.

The headlines are starting to pivot from bearish to bullish, and although we’re not quite out of the woods yet, we’re headed in the right direction.

Investors with CameronDowning have remained invested through this bear market cycle, so they needn’t be worried about “missing the bottom” - one of the heroic flaws of trying to time the market. As such, returns have pushed higher this first half of the year, and we remain optimistic as we enter the second half.

Stay connected with news and updates!

Sign up for our monthly newsletter for more personal finance and market insights.

We hate SPAM. We will never sell your information, for any reason.