Understanding Medicare, Parts A – D, and Medigap Policies

Jan 15, 2020By Glenn J. Downing, MBA, CFP®

Original Medicare is a creation of the Johnson administration in 1965. Medicare is health insurance for those aged 65+. There is a premium associated with coverage, and this premium is deducted from the Social Security Benefit. As with any government program, there is nothing easy to understand about Medicare. In this blog entry, I’ll cover the highlights.

Medicare vs. Medicaid

Please don’t confuse Medicare with Medicaid. Medicare is health insurance. Medicaid is a state welfare benefit, though partially funded with federal dollars. The Medicare beneficiary is age 65. Someone who has been receiving social security disability for more than 2 years is also covered. Coverage is for individuals, so a retiree of age 65 cannot cover his spouse of 63 on the same policy. This spouse will have to wait two more years to elect coverage.

Medicare Part A

Basically, Part A covers hospitalization and related expenses. If you are covered for Social Security retirement benefits you’ve already paid into the Medicare system. Your premium for Part A is therefore zero. If you don't have sufficient Social Security credits Medicare Part A is available for a premium.

In 2020 Medicare Part A pays in-hospital benefits for up to 150 days. Hospital stays are subject to a deductible of $1408 per benefit period. After that the Medicare beneficiary pays a coinsurance amount of $352/day for days 61-90 of the hospital stay. The coinsurance amount rises to $704/day for the remaining days, up to 150.

If you’ve been hospitalized for more than 3 days, then you are covered for post-hospital care in a skilled nursing facility for up to 100 days, as well as an unlimited number of post-hospital home health services. For the first 20 days, Medicare picks up the full tab. For the next 80 days Medicare pays everything over a daily deductible of $170.50. That means that your maximum exposure is (170.50 * 80) $13,640 out of pocket. Medicare Part A covers hospice care as well.

Medicare Part B

When you hear Medicare Part B, think doctors and tests. Part B covers doctor’s services (including surgeries) at the doctor’s office or other institution (e.g. hospital, assisted living facility, or nursing home). Also covered are diagnostic tests, radiology and pathology, drugs that cannot be self-administered, and limited treatment for mental illness. Part B also covers outpatient services from a participating hospital for treatment of an illness or injury, and unlimited home health services (same as Part A).

Preventive care services are also covered under Medicare Part B. These include mammograms and colorectal cancer screening, as well as an annual physical. Depression screening, counseling for alcohol misuse and obesity are covered. Medically necessary supplies, such as wheelchairs and walkers, are also covered under Part B, as are ambulance services.

What does it cost?

For part B, the premium is on a sliding scale by income. Generally, most pay $144.60 per month. Those newly enrolled can pay more if they missed their open enrollment period or their incomes exceed $174,000 married filing jointly (2020). After you’ve paid your annual deductible of $198 under Part B, you are responsible or 20% of approved charges – this is your out-of-pocket expense.

What’s excluded? Neither Part A nor Part B covers any dental expense nor dentures, nor do they cover eye exams or hearing aids. Although one flu shot per year is covered, most other immunizations are excluded. Rx drugs are also not covered under Parts A and B. You’re also on your own for that tummy tuck or eye lift.

Medicare Part C

Since there is Medicare Part A and B, and the relatively new Part D for prescription drugs (see later), then what is Part C?

Around 1/3 of Medicare beneficiaries choose to get their benefits from a Medicare Advantage Plan, aka Medicare private health plan, aka Part C. Medicare Advantage Plans contract with the federal government and are paid a fixed amount per person to provide benefits. These are typically HMOs (health maintenance organizations) and PPOs (preferred provider organizations. United, Aetna, and AvMed are some of the big players here.

You must have Medicare Parts A and B to enroll in a Medicare Advantage plan. There will generally not be an additional premium for this coverage. The benefits provided under Part C must generally be equal to or superior to those of original Medicare, with the exception of hospice care, which isn’t provided. Medicare Advantage plans may offer additional coverage such as vision, hearing, and dental, and/or health and wellness programs. Most plans include Medicare Part D (prescription drug coverage).

Medicare Part D

Medicare Part D is a creature of the Bush administration. It adds prescription drug coverage to Original Medicare. You cannot have drug coverage under both Part D and Medicare Advantage. If you at some point add Medicare Part D and already have a Medicare Advantage plan, that plan will need to delete its Rx coverage. There is no coverage anywhere in the Medicare program for over the counter drugs.

Medigap Policies

If you receive your Medicare directly from Medicare itself rather than from one of the Advantage plans, there are a lot of gaps in coverage. Any sort of hospital stay that lasts past 2 months could run up a tab of thousands of dollars. Medigap insurance can cover these out-of-pocket costs.

A Medicare Supplement Insurance policy, known as Medigap, is designed to cover the deductibles and co-insurance amounts of Parts A and B. These policies are sold by private insurance companies. To be eligible you must have Parts A and B, but cannot have Part C or an MSA (medical savings account) – these are mutually exclusive. They are sold to individuals, so a husband and wife need two policies. They are guaranteed renewable, meaning the insurance company can’t drop you due to your claims history.

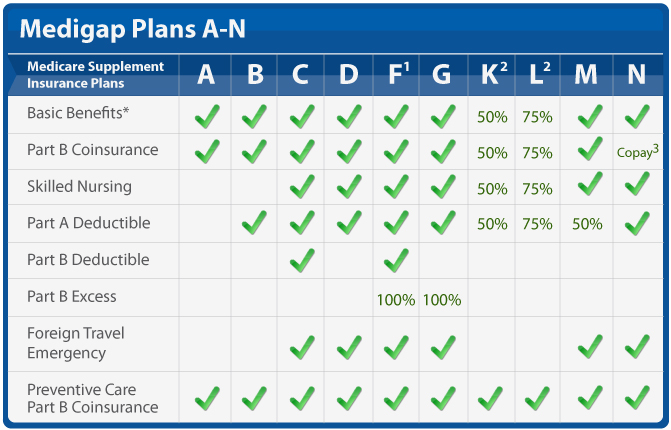

The coverage of Medigap policies vary by plan chosen – plans A through N. Please see the chart below. There is not a way to get 100% coverage – the insured must choose the coverage that’s most important.

Plans A – N

Why is this so important?

Health insurance coverage for someone who is planning retirement is a serious issue and one which requires due diligence. The largest financial risk a retiree faces is a long and debilitating illness. It is important to consider carefully the coverage to purchase, and the out-of-pocket costs associated with that coverage.

The rules for signing up for the various Medicare parts are complex (as is anything coming out of the federal government) and beyond the scope of this entry. I’ve done a Medicare video overview that you may find helpful. For more information, medicare.gov is a great resource.

Get in touch!

Questions? Feel free to get in touch with us at [email protected] Also follow us LinkedIn, Facebook, Instagram, and YouTube for more personal financial information relevant to you!

Stay connected with news and updates!

Sign up for our monthly newsletter for more personal finance and market insights.

We hate SPAM. We will never sell your information, for any reason.