I’ve mentioned earlier that I had an excellent public education. My high school was one of the finest in New England, and I had the best teachers of my academic career there. My high school was in Guilford, CT – founded 1639. Think about it – at the time of the American revolution, Guilford was a...

Kissinger and Kardashian

Anyone of my age remembers Henry Kissinger. He was known for his shuttle diplomacy, and was always all over the news. And he had the most annoying speaking voice ever – gravelly! It almost hurt to listen for more than a few minutes.

Years go by and now we have Kim Kard...

In September 2023, the S&P 500 index experienced its most significant monthly decline of the year, slumping by approximately 4.87%. This downturn was primarily attributed to the Federal Reserve's monetary policy decisions and statements. The central bank surprised markets with a more hawkish stance ...

In August, the S&P 500 fell 1.77% for the month, making it only the second negative month of 2023.

Positive sentiment took a significant hit in the first half of August, chiefly due to a surprise credit rating downgrade for the United States by Fitch, a conservative outlook from tech giant Apple, a...

The market rally persists, but the debate around a looming recession endures.

Key Takeaways:

- The S&P500 and NASDAQ both continued to gain in the month of July.

- The Dow Jones had its longest winning streak since 1987.

- The inflation report for the month of June showed its smallest increase sinc ...

The market rally continues, May inflation comes in cooler, and more.

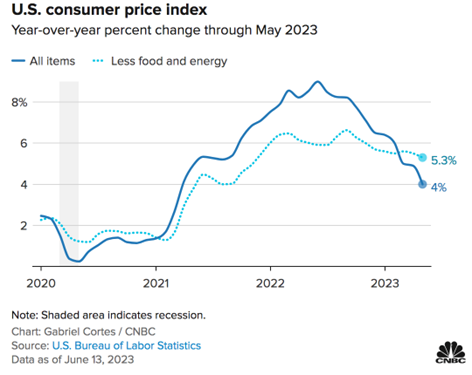

On Tuesday, June 13th the S&P500 hit a 52 week high. Right on the heels of a 4% Year-over-Year inflation read for the month of May.

Here’s where inflation stands:

Later that week, the Federal Reserve decided to skip interest r...

by Glenn J. Downing, MBA, CFP®

At CameronDowning we work with a lot of young professionals. These are people who are well-educated, hard-working, and striving for good things in life. They come to us for financial organization – to get their life’s financial underpinnings squared away – to establ...

by Glenn J. Downing, MBA, CFP®

On June 5th of this year Gov. DeSantis signed into law some major changes – upgrades - to the Deferred Retirement Option Program. The main points are these:

DROP extended to 8 years

Beginning July 1st the DROP term has been extended from 5 years to 8. P...

The Federal Reserve meets again on June 13th-14th for its periodic Federal Open Market Committee (FOMC) meeting. This meeting is a critical one. There is a general expectation that the Fed will finally pause historic rate increases at this meeting. To illustrate the point, a May 23rd Forbes headlin...

by Glenn J. Downing, MBA, CFP®

Congratulations! You did it! You launched a new business, worked you’re a** off, and now have a going enterprise. It wasn’t there before – it exists because of you and your team. A huge accomplishment, and something of which to be very very proud.

A few years ha...

by Glenn J. Downing, MBA, CFP®

There's a lot of financial stress out there - we hear it from our clients. People who don't have a financial worry in the world are afraid. And, given two high profile bank failures recently and the release of the Durham report last week, I suspect there are lots of...

by Glenn J. Downing, MBA, CFP®

One of our specializations here at CameronDowning is financial planning for attorneys. We love working with lawyers! As a rule, they keep appointments, provide documents as requested, understand paying professional fees (after all, they charge such fees themselves),...