How to get a big pay hike

If you want a big pay hike, sometimes the only way you're going to get it is by jumping ship to a new employer who values your skill set and experience and is willing to pay for it. Otherwise you may have to settle for an annual cost of living increase. People will make s...

As we enter May of 2023 the stock market is up on the year, despite the banking crisis we've experienced in the last couple months. The failure of First Republic Bank, which was taken over by banking giant JP Morgan Chase, was no surprise as the bank had been on life support ever since the collapse ...

So Glenn – Can I retire at 60?

This is a tough one. Lots of people want to retire early, and for various reasons. But there are lots of moving parts to this. Let’s break it down a bit.

Where will you get health insurance?

This is your very first consideration, even before the money. You know...

No More Revenge Spending

There’s a new term out there – revenge spending. When people were hunkered down during COVID, they couldn’t go out to spend. When things opened up, people took their revenge on the lockdowns and spent like never before. And the government has joined the party. As Ronald...

As I’ve noted elsewhere, it used to be that if a man wanted to impress a woman, he’d flash a bankroll. Now she’d likely flee in horror at such Neanderthal-like behavior. It is the platinum card she wants to see. On second thought, actually using a credit card might also be too old-school for her ...

Simplified Employee Pension

The Simplified Employee Pension (SEP) is a great way for the self-employed to save for retirement. There are several ins and outs with a SEP, and I want to go over the main ones. My focus is on the self-employed, as the SEP rules are different for the corporate employe...

If you’re over 70 ½, have an IRA, and give significantly to charitable organizations – pay attention! I’m writing about the Qualified Charitable Distribution – QCD - a great tax benefit.

Here are the specifics: you can do a direct distribution from an IRA to a charity without it being a taxable ...

Tax Reasons for the Subchapter S Election

There are lots of great reasons to organize your business as a corporate entity with a Subchapter S election. You have limited personal liability, flow-through of net income, ability to take a Section 199A deduction, and ability to, as the owner, split you...

Now that I’m a beneficiary of Social Security, I know whereof I write. The SSA is now a part of my life, my wife’s life, and for better or for worse will be until we’ve assumed room temperature.

I began drawing my retirement benefit at age 66, which was my Normal Retirement Age. NRA has been slo...

They don’t teach young people anything in school anymore.

How many of my readers have thought this exact same sentence at one point or another? I usually think it when I made a reference to literature or music that someone else doesn’t get. I mean, hasn’t everyone read Charles Dickens? Doesn’t ...

January of 2023 kicked off with a bang. We’re in the midst of a stock market rally that we haven’t seen in over a year. The market rose, and rose, and kept rising – all in the last 8 weeks. We’re far from all-time highs, and expect that to be the case for a while yet, but this is a positive sig...

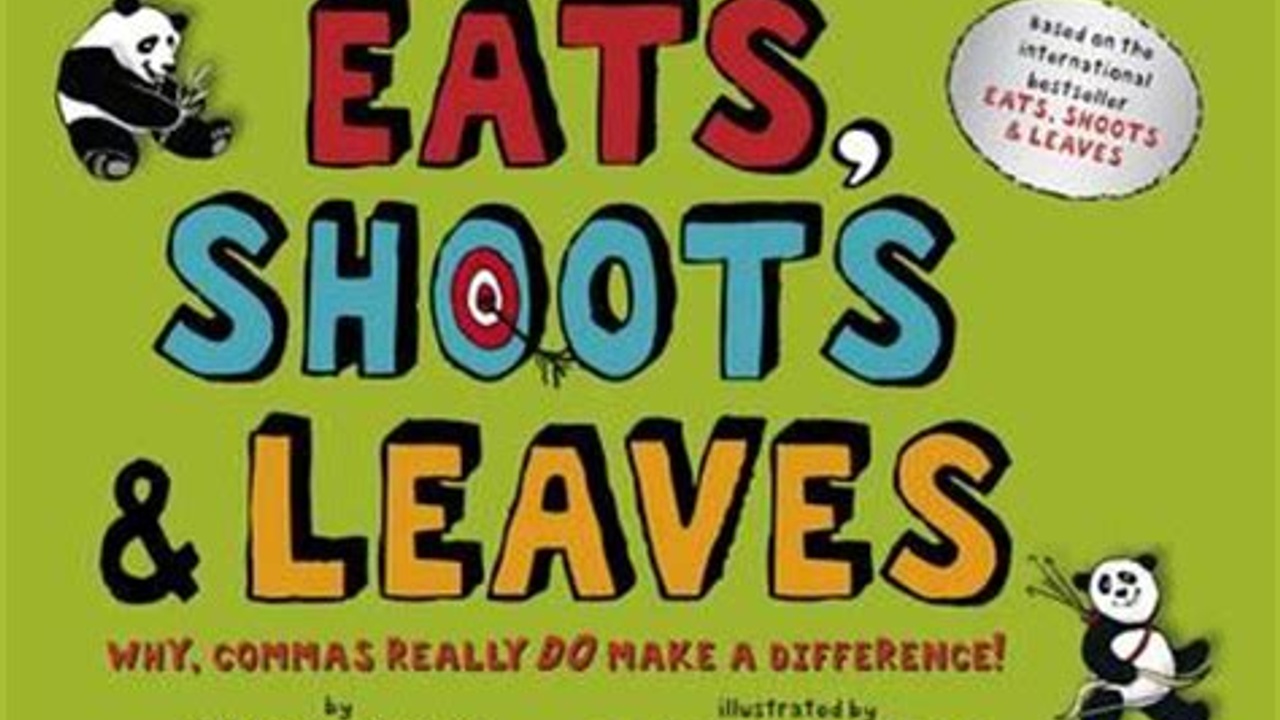

I’ve always loved language. I won both the English and Spanish prizes at my high school graduation. The turn of a phrase, or change in meaning a comma can make, have always fascinated me. If you haven't read Lynne Truss' excellent and funny book on punctuation, do so!

For this post I’m gathering...